US INDIVIDUAL SERVICES

File2Fed offers services to the Individual who is required to file his/her Tax Return to the Federal as well as State and City. The person has to file tax return once his/her income reaches to certain threshold limit. People who doesn’t required to file but can file in order to get some refundable credits and economic impact payments.

Along with Federal, File2Fed covers all taxable States and Cities to file Taxpayer’s Income Tax Return. Having vigorous communications with Federal’s and State’s Tax Agencies is an added advantage.

List of internal services File2Fed can perform:

Federal, State and City Tax Return Filing.

E-filing and Paper-filing

FBAR and FATCA filing

Applying/Renewal ITIN (Passport Certification available)

Audit Protection Shield

Query/Audit Protection

Form W-4/W-8/W-9 filling Assistance or Guidance

Amendment fillings

Audit guidance for previous returns done by Others/Self

Track your Refund/Payment for Due/Get a Transcript

Representation/IRS Consultation

Expert Scheduled Meetings

Apply for Extension

Tax Savings Tips

Qualified and expertise professionals will only take up all the technical works includes Research Analysis, Planning, Execution and getting Desired Output. The desired output comes after having 3-stage review filtration which has done by the experienced Tax Experts. Our executives are very much responsible for receiving inputs and delivering outputs to clients within the stipulated time. Also, they will take care of arranging experts meet on demand of our esteemed clients.

File2Fed covers Federal and all taxable States & Cities (which includes county taxes) by filing Individual Tax Returns (Form 1040, Form 1040NR, Form 1040X and related Schedules) before the due date. IRS probably issues April 15th is the due date for filing and paying taxes.

Basically, there are 2 types of filing options available for the individuals to file their respective Tax Returns.

E-file

Paper-file

E-file: It is an electronic file by which we can file individual tax returns electronically. We recommend this filing option for the people who are eligible for both e-filing and paper filing. The advantages of e-filing are easy to file, easy to track return status & refund status and get notified once your bank account hit with refund amount.

Paper-file: It is a manual filing; individuals can file their tax returns by mailing documents to the IRS address after having sign and date manually.

Note: File2Fed will take care of everything by giving all required documents with proper instructions and clear steps to follow. Even though it’s manual we can make it simple and easy for the Taxpayer.

Who has to file through this option?

Generally, people who required to choose paper version filing are (Some exceptions are available),

Non-Resident aliens

ITIN cases

Students/Trainees/Teachers

Amendment cases etc.,

FBAR (Foreign Bank Account Report): All US Citizens and Residents, Corporation, Partnership, LLC, Trust and Estate whose aggregate value of their Foreign Financial Accounts (such as bank accounts, brokerage accounts and mutual funds etc) exceeds $10,000 at any time during the tax year are needed to report FinCEN (Financial Crimes Enforcement Network) by filing Form 114 electronically through BSA E-Filing System. The actual due date to file FinCEN form is April 15th and do not file FBAR with Federal Tax Return, it is a separate annual report to the FinCEN. Automatic Extension will be available up to October 15th without any application. Penalties applicable if fail to report to the FinCEN.

For more Info kindly visit: https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

FATCA (Foreign Account Tax Compliance Act): US Taxpayers who have foreign financial assets more than certain threshold limits must report to the IRS by filing Form 8938 (Statement of Specified Foreign Financial Assets) along with the Annual Federal Income Tax Return. The due date for FATCA is same as Annual Federal Tax Return generally falls on April 15th. Penalties are applicable if it fails to report to the IRS.

Specified foreign financial assets include foreign financial accounts and foreign non-account assets held for investment (as opposed to held for use in a trade or business) such as foreign stocks and securities, foreign financial instruments, contracts with non-U.S. persons and interests in foreign entities.

You must file Form 8938 if you must file an income tax return and:

You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year

You are married, filing a joint income tax return and the total value of your specified foreign financial assets is more than $100,000 on the last day of the tax year or more than $150,000 at any time during the tax year.

You are married, filing separate income tax returns and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year.

For more Info kindly visit: https://www.irs.gov/businesses/corporations/foreign-account-tax-compliance-act-fatca

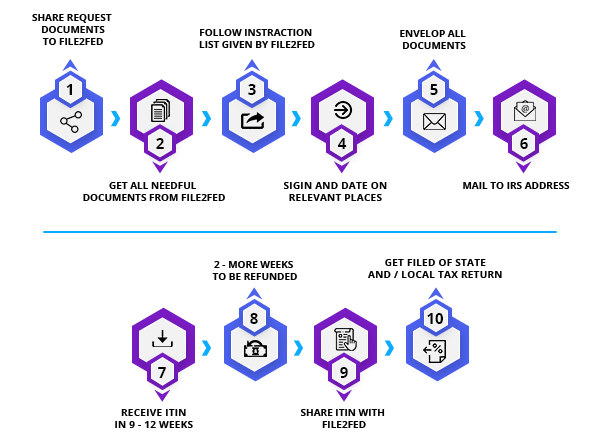

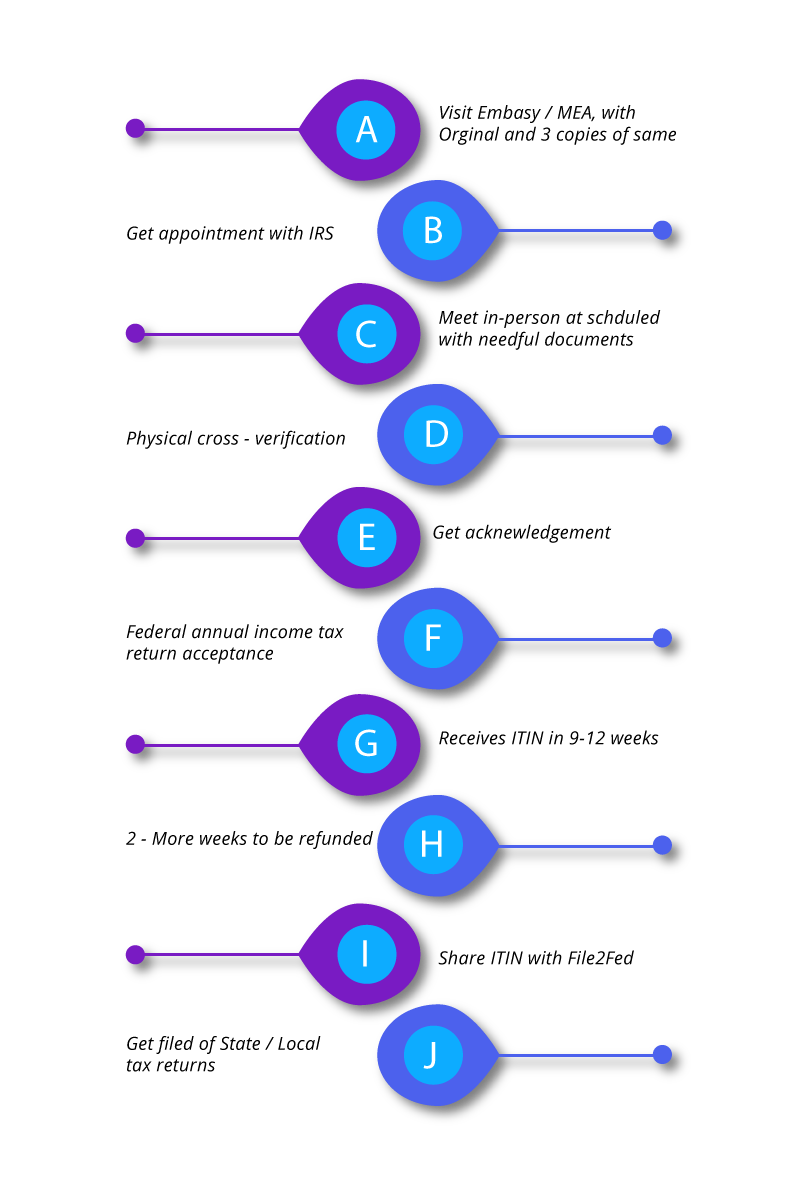

For newly/renewal will have two options to get the ITIN

In-Person Meet

In-Person Meet

For renewals can renew their expired (or going to expire by the time of filing tax returns) ITINs along with Annual Federal Income Tax Return filing. Must use ITINs on Federal Income Tax Return at least once in the last three years for keeping them in active. Although ITINs with middle digits “88” issued before 2013 will going to expire at the end of 2020.

For more info kindly visit: https://www.irs.gov/individuals/individual-taxpayer-identification-number

Since Tax Agencies having the right to re-verify the previously filed tax return any time in 3-year period after the tax return has filed, File2Fed came up with this feature in order to prove its matter of accuracy guarantee and to build the confidence in the trusted customers. It is a refundable protection deposit against accuracy/math error. Availed customer can withdraw from this choice at any time during 3-year period from the date of payment to File2Fed and get fully refunded.

If a customer faces any challenges made by the tax agencies asked to prove accuracy against the tax return prepared by File2Fed will have the Protection Shield to get protected from these by making this choice, which costs $49 and its completely refundable within 3-year period. T&C apply.

Terms and Conditions:

3-year validity for withdrawing from this Shield Protection

Once withdrawn in valid time period amount of $49 will be refunded

Customer must share us the scanned copy of complete letter/notice issued by the tax agencies in a week, it gives enough time to ‘Audit Rescue Team’ to act on it from the customer’s favour and ensure to resolve it. Also, customer will be ready to share the tax related information upon the request of File2Fed in resolving process.

Benefits against protection shield will vary according to the conditions

If File2Fed unable to solve,

Refund $49

Refund charges you pay for return

Refund additional penalty you pay for tax agencies

Free Amended Return to be filed

5 years free tax services from the date of protection shield availed

If File2fed solved,

It turns non-refundable and get expire

Best Discounts and offers in 3-year period will be applicable to the customer up to 3 years from the date of Shield applied.

If 2021 shield applied, for best benefits we compare 2019,2020 and 2021 offers and discounts, and apply best benefited year

offer for the 2021 year. Process is same for next two years (2022-23).

Example: If shield applied – 2021

For 2021 year – compare 2019,2020 and 2021 discounts and offers – apply best year offer

For 2022 year – compare 2020,2021 and 2022 discounts and offers – apply best year offer

For 2023 year – compare 2021,2022 and 2023 discounts and offers – apply best year offer

If no letter/notice in 3-year period

Applicable benefits are same as ‘If File2Fed Solved’

The withdrawn availability from this Shield Protection will get expire and have no refund

At the time of filing customer has to provide us valid, correct, relevant and accurate information. If customer fails to provide in same manner File2Fed will no longer be the responsible for the challenges made by the tax agencies on this particular filed return but assists the customer in handling letter/notice has received.

Audit Protection Shield will only applicable to the tax return you paid to choose shield

The Shielded Tax Return will have 3-year protection time from the date of shield to be chosen

The definition of Shield/Protection Shield will be same as Audit Protecting Shield

The definition of withdrawing/withdrawn is nothing but terminating the shield

The definition of Tax Agencies includes Federal and all State Tax Departments

If no Audit Protection Shield, dedicated Audit Assistance Team will assist customer until the query get resolve, if it fails 80% of charges you paid for our services will be refunded only when the information you provided us is relevant, valid, correct and accurate at the time of filing.

A dedicated team consisting of highly qualified tax experts is allocating for the people who have been noticed or queried. This team will take care of everything and tries to bring situations under control in customers’ favour. We guide you in each and every step and sometimes File2Fed could act as a third-party designee after being granted authorization for the purpose of resolving federal tax issues or represent before the IRS. This authorization is a “Power of Attorney” and is submitted using Form 2848.

File2Fed will guide you on filling of Form W-4/W-8/W-9.

Form W-4 (Employee withholding and Allowances Certificate): it is IRS form needed to complete by an employee and provided to his/her employer. This form determines employee tax situation to employer who is responsible for withholding employee taxes from employee’s pay check on basis of Form W4.

Form W-8: This is IRS form can be used by non-resident alien and/or foreign business having earned income from U.S sources. The main purpose of this form is to verify the country of residency for tax purposes and certify that they qualify for lower rate of tax withholding. This form should be filed and submitted to payers or withholding agents but not to IRS. Failure to submit may result 30% tax withholding applies to foreign entities. Since W8 series forms are bit complex, a professional advice will helpful in completing these forms. Five W8 forms are available and proper selection is needed when completing them.

Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting-Individuals)

Form W-8BEN-E (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting-Entities)

Form W-8ECI (Certificate of Foreign Person’s Claim That Income Is Effectively Connected with The Conduct of Trade or Business in The United States)

Form W-8EXP (Certificate of Foreign Government or Other Foreign Organization For United States Tax Withholding and Reporting)

Form W-8IMY (Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting)

Form W-9 (Request for Taxpayer Identification Number and Certification): It is IRS form can be used by citizens and resident aliens to verify the Name, Address and Tax Identification Number (TIN) of employer or other entities. The Information taken from Form W-9 is often used to generate a Form 1099, which is required for Income Tax purposes.

The taxpayer who is required to do some changes in the already filed tax return can have the choice of using Form 1040-X, Amended U.S. Individual Income Tax Return. Changes might be including correct Form 1040, Form 1040-NR, or Form 1040-NR EZ, make elections after the prescribed deadline, change any amounts previously adjusted by the IRS, make a claim for a carry back due to a loss or unused credit etc. Taxpayer must use the Form 1040-X within three years from the date the original return has filed or within two years from the date taxes were paid, whichever is later.

If anyone who filed his/her previous tax return with other consultancies/private-agencies/by-self has been affected by an unsolved letter/notice, File2Fed is there with you to solve or guide you how to sort out that raised notice/letter.

File2Fed creates easy and convenient way to each valuable customer to track status of their refunds. Also, if it is in due condition can easily pay to the federal and state departments by proper selection of requested input formats. Then tax payer redirects to the official page where you can give requested inputs and proceed.

The IRS will have the authority to re-examine the filed tax return and related tax information from the Taxpayer’s books or tax records considered on filed tax return. If IRS find irrelevant/erroneous/false information on the filed tax return then IRS issue an audit to urge taxpayer has to prove the Audit related stuff. The Audit issuing will be happening within three years after the filing has done.

Taxpayer representation is the process of assisting our customers in dealing with various taxing authorities, negotiating payment plans or settlements, and representing our clients in court. File2Fed is providing ‘Audit Assistance Team’ to represent customers on a variety of their taxation issues and guide them through the dispute process ranging from a collection action to administrative appeals through litigation. To represent before the IRS, we need authorization that should be given by the taxpayer by using Form 4868, Power of Attorney.

Important Note: File2Fed urges taxpayer to keep the records that are relevant with respect to the filed tax returns for at least 3 years from the date the tax return has filed in order to save from an unexpected Penalties and Interests

File2Fed always welcomes the customer to get meeting with our experts to resolve their Queries / Tax related matters / Business growth strategies / Tax savings tips. Customer can schedule expert meet through his/her login, e-mail, or over phone.

Email Id - contact@file2fed.com

Call us - +1 786-765-1303

File2Fed can apply extension on behalf of you in order to get 6-monnth extension time to file. So, Taxpayer will get an additional 6-month time i.e., up to OCT 15th.

NOTE: Please make sure that extension is only for filing purpose. If you are in due condition you must pay departments on or before April 15th, otherwise department will levy penalties/interests on due amount which is not paid by regular due date. Where department includes federal, state, city, and/or county.